Canada’s Economic Landscape: 2019 to 2024

Introduction

Today, we’re diving into a topic that’s both crucial and timely: Canada’s economic landscape and how it compares to the pre-pandemic days of 2019. We’ll break down key indicators like the unemployment rate, inflation, and the Bank of Canada’s overnight rate. By the end of this blog, you’ll have a clearer picture of where we stand today and what it means for you, your wallet, and your mortgage.

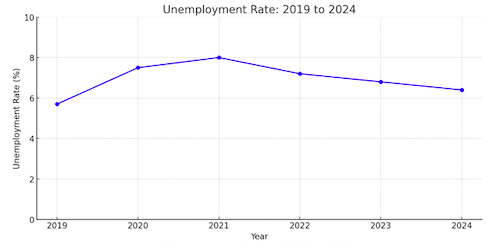

Unemployment Rate: Then and Now

2019 (Pre-Pandemic): 5.7%

2024: 6.4%

Change: +0.70% (rate of +12%)

Back in 2019, the unemployment rate was a relatively low 5.7%. Fast forward to 2024, and it has jumped to 6.4%. This 12% increase might seem small at first glance, but it signals significant challenges in the job market. More Canadians are struggling to find work compared to the pre-pandemic era, which affects everything from household income to overall economic confidence.

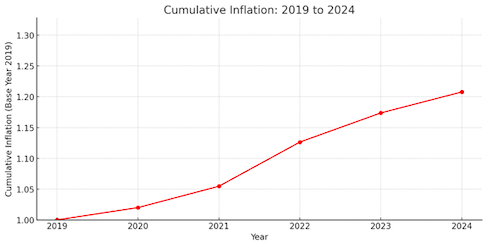

Inflation: The Silent Wallet Killer

2019 (Pre-Pandemic): 1.9%

2020 – 2023: 14.73%

2024: 2.9%

Change: +17.63%

Inflation, the silent wallet killer, has been a Canadian burden since 2021. In 2019, the average inflation rate was 1.9%. Today, it’s at 2.9%. However, the real damage was done between 2019 and 2024. The Canadian dollar was devalued by 14.73% over those 3 years. This is near double our ‘normal’ rate of 2.50% per year (7.50% total over 3 years). On average, your dollar can buy 17.63% less than it did in 2019. That’s 17% less in groceries, clothing, entertainment, etc.

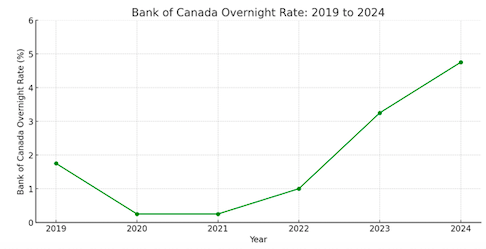

Bank of Canada Overnight Rate: The Cost of Borrowing

2019 (Pre-Pandemic): 1.75%

2024: 4.75%

Change: +3%

The Bank of Canada’s overnight rate has seen a dramatic increase. In 2019, the rate was a mere 1.75%. As of 2024, it has skyrocketed to 4.75%. This 271% increase makes borrowing significantly more expensive. Whether you’re looking at mortgages, personal loans, or business financing, higher interest rates mean higher costs.

Breaking Down the Numbers

Unemployment

- 2019: 5.7%

- 2024: 6.4%

- Increase: 12%

What does a 12% increase in unemployment look like? Imagine a small town of 10,000 people. In 2019, 570 of them were unemployed. Today, 640 are without jobs. While these numbers might not seem drastic, each percentage point represents real people facing real challenges.

Inflation

- 2019: 1.9%

- 2024: 2.9%

- Increase: 1%

This 1% increase means that the cost of goods and services has risen more than usual. If you were spending $100 on groceries in 2019, you’d now need to spend about $102.90 for the same items. Over time, this adds up, squeezing your budget further.

Bank of Canada Overnight Rate

- 2019: 1.75%

- 2024: 4.75%

- Increase: 271%

A 271% increase in the overnight rate translates to significantly higher interest on loans. If you had a mortgage with a 3% interest rate in 2019, it might now be closer to 6%. This could mean hundreds more in monthly payments, putting additional strain on your finances.

What This Means for Canadians

The changes in these economic indicators have profound implications for Canadians. Let’s break it down further:

Employment Challenges

With a higher unemployment rate, job security becomes a concern for many. More people are competing for fewer jobs, and some industries are slower to recover than others. This can lead to financial instability for many households, affecting their ability to meet mortgage payments and other financial obligations.

Reduced Purchasing Power

Inflation erodes the value of your money. When prices rise faster than your income, your standard of living declines. This is particularly concerning when the inflation rate exceeds expectations, as it has in recent years. The extra 5.13% devaluation means Canadians are feeling a bigger pinch than anticipated.

Costlier Borrowing

Higher interest rates from the Bank of Canada mean that borrowing money is more expensive. This affects not just new loans but also variable-rate mortgages and lines of credit. Higher borrowing costs can lead to higher monthly payments and make it harder for people to qualify for loans.

Housing Market Impact

The increase in interest rates has a significant impact on the housing market. Higher mortgage interest rates mean that fewer people can afford to buy homes, which can lead to a slowdown in the real estate market. This can also affect property prices, as the demand for housing decreases. Existing homeowners with variable rate mortgages or lines of credit may see their monthly payments increase, potentially leading to financial stress.

Mortgage Choices: Fixed vs. Variable Rates

Given the higher interest rates, many Canadians are reconsidering their mortgage options. Fixed-rate mortgages, which offer stability and predictability in payments, become more attractive compared to variable rate mortgages that can fluctuate with the market. This shift can affect long-term financial planning and the overall housing market dynamics.

Debt Consolidation Challenges

Higher borrowing costs also impact those looking to consolidate debt. Debt consolidation, which can simplify multiple high-interest debts into a single, lower-interest loan, becomes less appealing when interest rates are high. This can leave individuals with fewer options to manage their financial situations effectively.

Putting It All Together

To sum it up, here’s what these changes mean in simpler terms:

- Higher Unemployment: There are more people without jobs now compared to 2019, which can lead to greater financial stress for families.

- Decreased Purchasing Power: Your money doesn’t go as far as it used to, making it harder to afford everyday items and save for the future.

- Increased Borrowing Costs: Loans and mortgages are more expensive, making it tougher to buy a home or finance other major purchases.

- Housing Market Slowdown: Higher interest rates can cool down the housing market, affecting property prices and mortgage payments.

What Can You Do?

While these changes can seem daunting, there are steps you can take to navigate this economic landscape:

Budget Wisely

Keep track of your expenses and look for areas where you can cut costs. Every little bit helps.

Seek Financial Advice

A financial advisor can help you create a plan to manage your finances and make the most of your money.

Consider Fixed-Rate Mortgages

With interest rates high and likely to fluctuate, a fixed-rate mortgage can provide stability and predictability in your payments.

Explore Home Equity Options

If you own a home, consider using a home equity loan or line of credit to consolidate debt or finance major expenses. Just be mindful of the higher interest rates and ensure you have a solid repayment plan.

Stay Informed

Keep up with economic news and trends. Being informed can help you make better financial decisions.

Review Your Mortgage Terms

If you’re already a homeowner, review your mortgage terms and consider refinancing options. Locking in a lower fixed rate now could save you money in the long run, especially if rates continue to rise.

Manage Debt Carefully

Be cautious with taking on new debt and focus on paying down existing high-interest debt. This will help you maintain a healthier financial position amid rising borrowing costs.

Conclusion

The economic landscape in Canada has shifted significantly since 2019. Higher unemployment, increased inflation, and rising interest rates have created new challenges for Canadians. By understanding these changes and taking proactive steps, you can better navigate this new reality. Remember, it’s not all doom and gloom—being informed and prepared can make a big difference.

If you’re struggling with your finances and need financial guidance contact us today!

Stay tuned to Morgix for more insights and advice on navigating the ever-changing world of mortgages and finance. Until next time, keep your financial goals in sight and stay proactive!